Navigating the NYCERS 2025 Pension Payment Calendar: A Comprehensive Guide

Related Articles: Navigating the NYCERS 2025 Pension Payment Calendar: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the NYCERS 2025 Pension Payment Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the NYCERS 2025 Pension Payment Calendar: A Comprehensive Guide

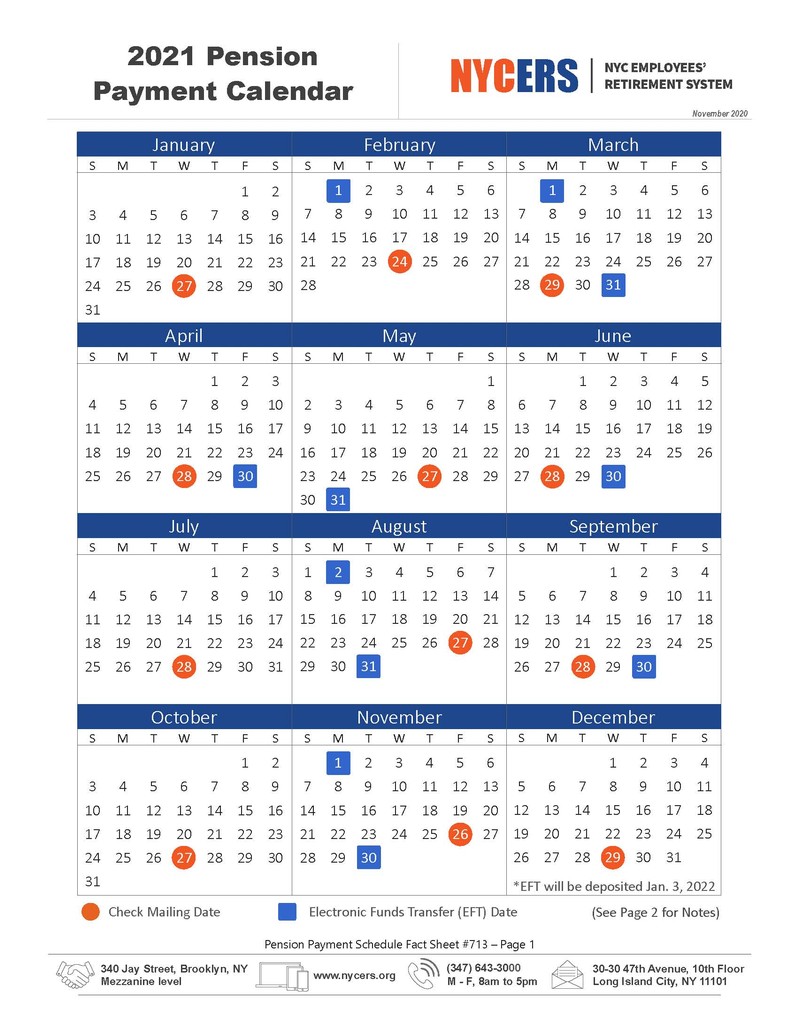

The New York City Employees’ Retirement System (NYCERS) provides retirement security for thousands of city employees. Understanding your pension payment schedule is crucial for effective financial planning. This article delves into the intricacies of the NYCERS 2025 pension payment calendar, offering a comprehensive guide for retirees and those nearing retirement. While a specific, pre-published calendar for 2025 isn’t readily available this far in advance, we can explore the established patterns, potential variations, and essential information to help you anticipate and prepare for your 2025 pension payments.

Understanding the NYCERS Payment Structure:

NYCERS pension payments are typically distributed monthly. The exact payment date varies depending on several factors, including:

- Payment Method: The method you choose to receive your payment (direct deposit, check) can slightly affect the timing. Direct deposit generally ensures faster and more reliable delivery.

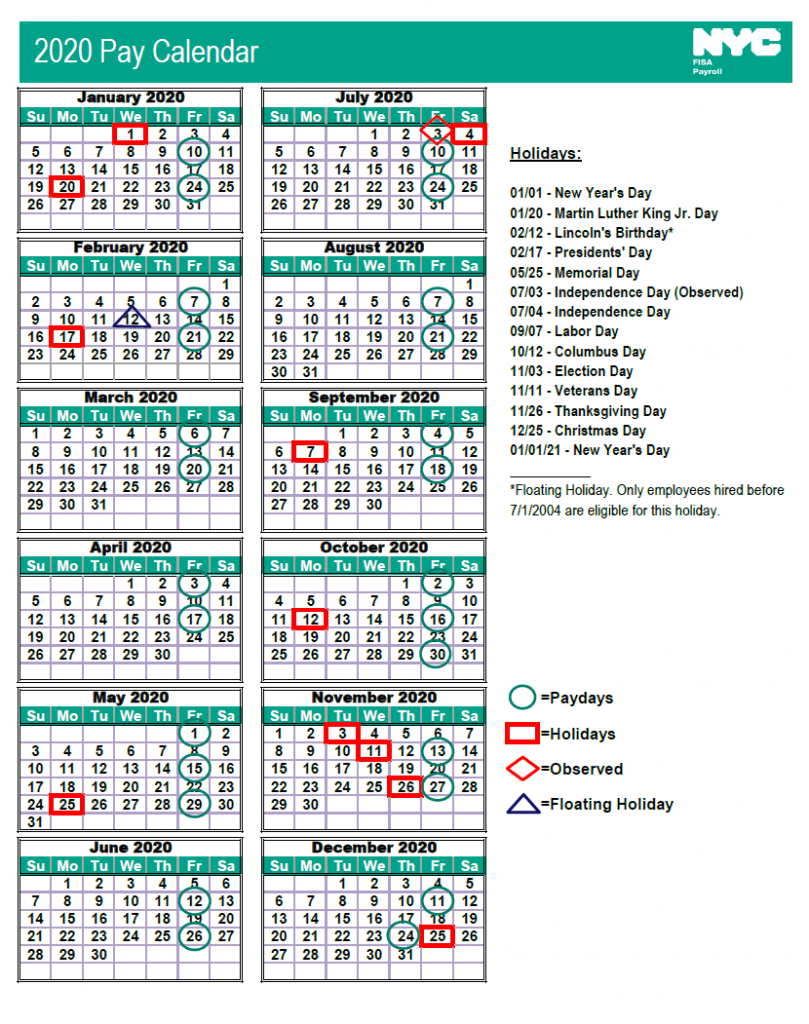

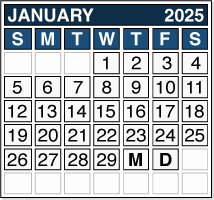

- Bank Holidays: Payments are adjusted to avoid weekends and bank holidays. If the regular payment date falls on a weekend or holiday, the payment is typically made on the preceding business day.

- System Processing: While NYCERS strives for consistent payment schedules, occasional system processing delays might cause minor variations.

Predicting the 2025 Payment Calendar:

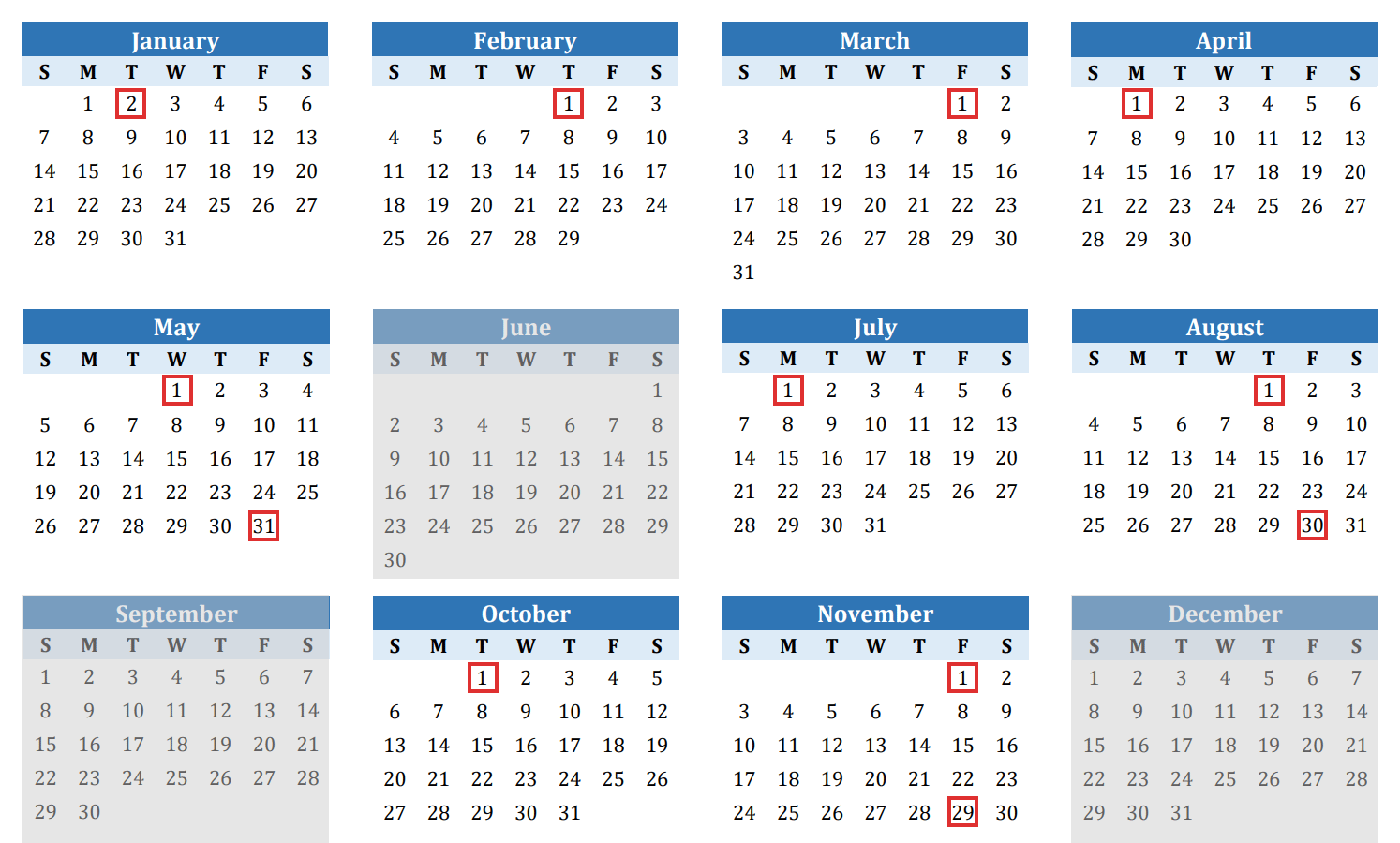

While a definitive 2025 calendar isn’t available yet, we can extrapolate from past payment schedules. NYCERS generally follows a consistent pattern, with payments made around the same day of the month. Reviewing your past payment statements will give you the most accurate prediction for your individual 2025 payment schedule. Look for recurring patterns in the payment dates. Were your payments consistently on the 1st, 15th, or another specific date each month? This historical data provides the most reliable forecast.

Accessing Your Payment Information:

NYCERS offers several ways to access your personalized payment information:

- Online Account: The NYCERS website provides a secure online portal where you can view your payment history, upcoming payment dates, and account details. Regularly checking your online account is the most efficient way to stay informed.

- MyNYCERS Mobile App: The mobile app offers convenient access to your account information, including payment details, on your smartphone or tablet.

- Written Correspondence: You can contact NYCERS directly via mail or phone to request your payment information. However, this method is generally slower than online access.

Factors Affecting Payment Amounts:

Several factors can influence the amount of your monthly pension payment:

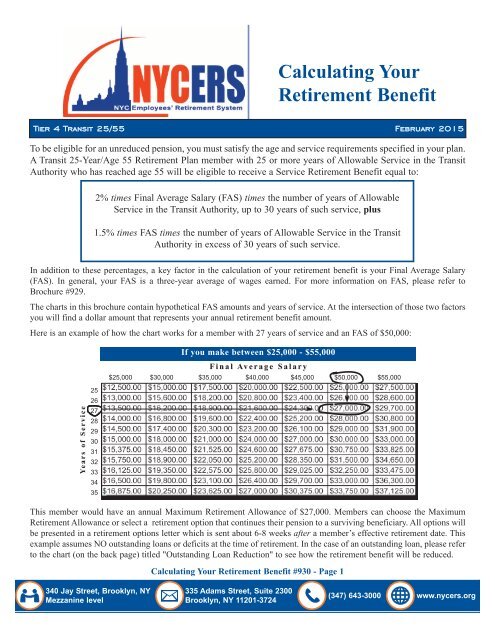

- Years of Service: The longer you worked for the city, the higher your pension benefit will likely be.

- Final Average Salary: Your average salary during your highest-earning years significantly impacts your pension calculation.

- Tier: NYCERS has different tiers, each with its own benefit formula. Your tier depends on when you started working for the city.

- Cost-of-Living Adjustments (COLAs): NYCERS may adjust pension payments annually to account for inflation. The COLA percentage varies depending on the year and economic conditions. Keep in mind that COLA adjustments are not guaranteed and can be subject to change based on legislative decisions and funding availability.

Planning for 2025 and Beyond:

Preparing for your retirement income requires careful financial planning. Consider these points when anticipating your 2025 pension payments:

- Budgeting: Once you have a reasonable estimate of your monthly pension payments, incorporate them into your budget. Account for potential variations in payment amounts due to COLAs or other factors.

- Healthcare Costs: Factor in the cost of health insurance and other medical expenses, which can be a significant portion of your retirement budget. Understand the healthcare options available to NYCERS retirees.

- Supplemental Income: Determine if you need supplemental income sources, such as Social Security, part-time employment, or savings, to meet your financial needs.

- Tax Implications: Consult a tax advisor to understand the tax implications of your pension income. Pension income is generally taxable at the federal level and may also be subject to state and local taxes.

- Estate Planning: Consider how your pension benefits will be distributed after your death. Understand the survivor benefit options available through NYCERS.

Addressing Potential Concerns:

- Payment Delays: While rare, payment delays can occur. If you experience a delay, contact NYCERS immediately to inquire about the status of your payment.

- Changes in Benefit Structure: While unlikely to significantly alter existing pension plans, always stay informed about any potential changes to the NYCERS system through official communication channels. Regularly review information provided by NYCERS to stay updated on any relevant policy changes.

- Accuracy of Payments: Always verify the accuracy of your payment amounts. If you notice any discrepancies, contact NYCERS promptly to address the issue.

Conclusion:

While a specific NYCERS 2025 pension payment calendar is unavailable this far in advance, understanding the system’s structure and accessing your personal payment information online are crucial steps in preparing for your retirement income. By reviewing past payment dates, utilizing available online resources, and engaging in proactive financial planning, you can confidently anticipate and manage your NYCERS pension payments in 2025 and beyond. Remember to proactively contact NYCERS with any questions or concerns; their customer service representatives are available to assist you. This proactive approach will ensure a smoother transition into retirement and help you manage your finances effectively. Thorough planning and consistent monitoring of your account will allow you to enjoy a secure and comfortable retirement.

Closure

Thus, we hope this article has provided valuable insights into Navigating the NYCERS 2025 Pension Payment Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!