Navigating the GS Pay Period Calendar 2025: A Comprehensive Guide for Federal Employees

Related Articles: Navigating the GS Pay Period Calendar 2025: A Comprehensive Guide for Federal Employees

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the GS Pay Period Calendar 2025: A Comprehensive Guide for Federal Employees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the GS Pay Period Calendar 2025: A Comprehensive Guide for Federal Employees

The General Schedule (GS) pay system governs the salaries of millions of federal employees across the United States. Understanding the GS pay period calendar for 2025 is crucial for accurate budgeting, leave planning, and overall financial management. This comprehensive guide will delve into the intricacies of the 2025 calendar, providing valuable information and resources to help federal employees navigate their compensation effectively.

Understanding the GS Pay System and its Calendar

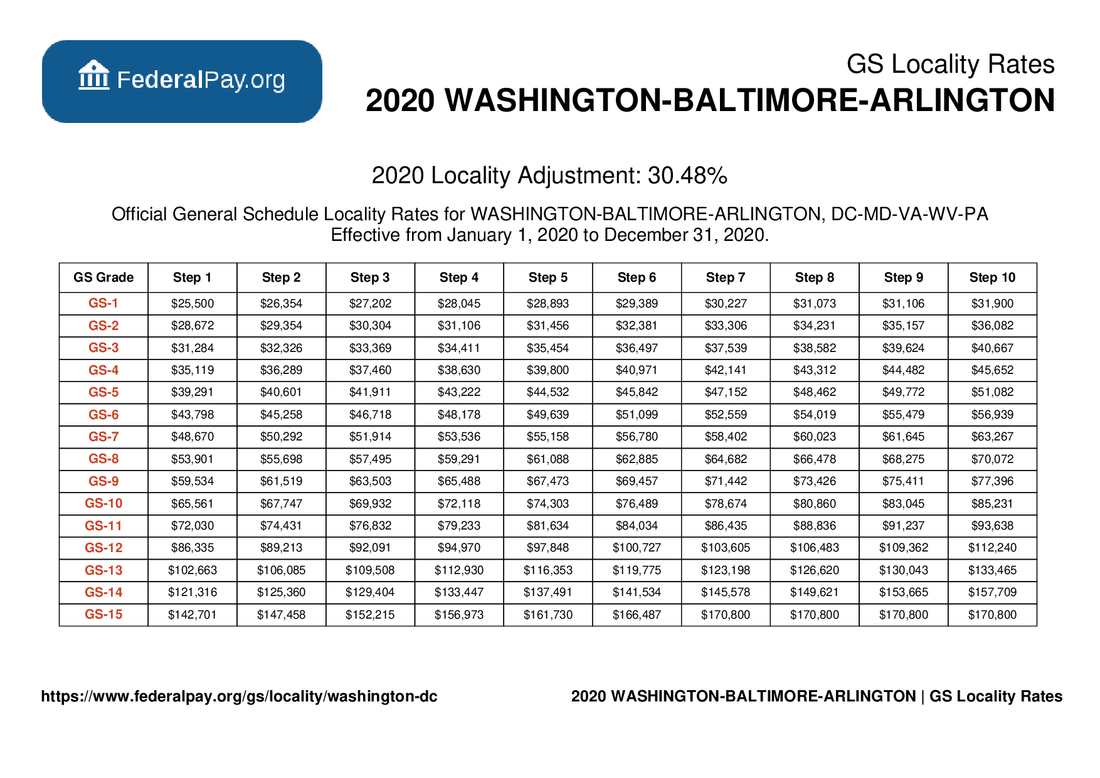

The GS pay system is a structured compensation system that categorizes federal employees based on their grade (GS-1 through GS-15) and step within that grade. Each grade represents a different level of responsibility and experience, with higher grades corresponding to greater pay. Steps within a grade reflect years of service and performance. The pay scale is adjusted annually based on cost-of-living adjustments (COLAs) and other economic factors.

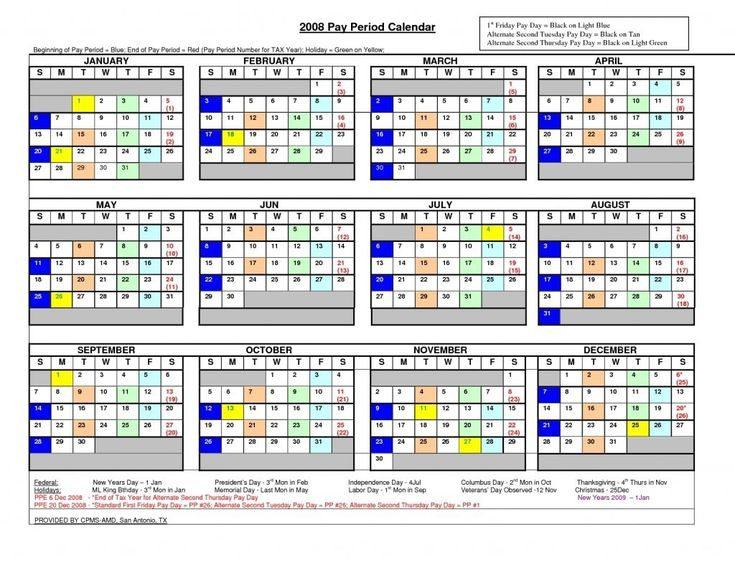

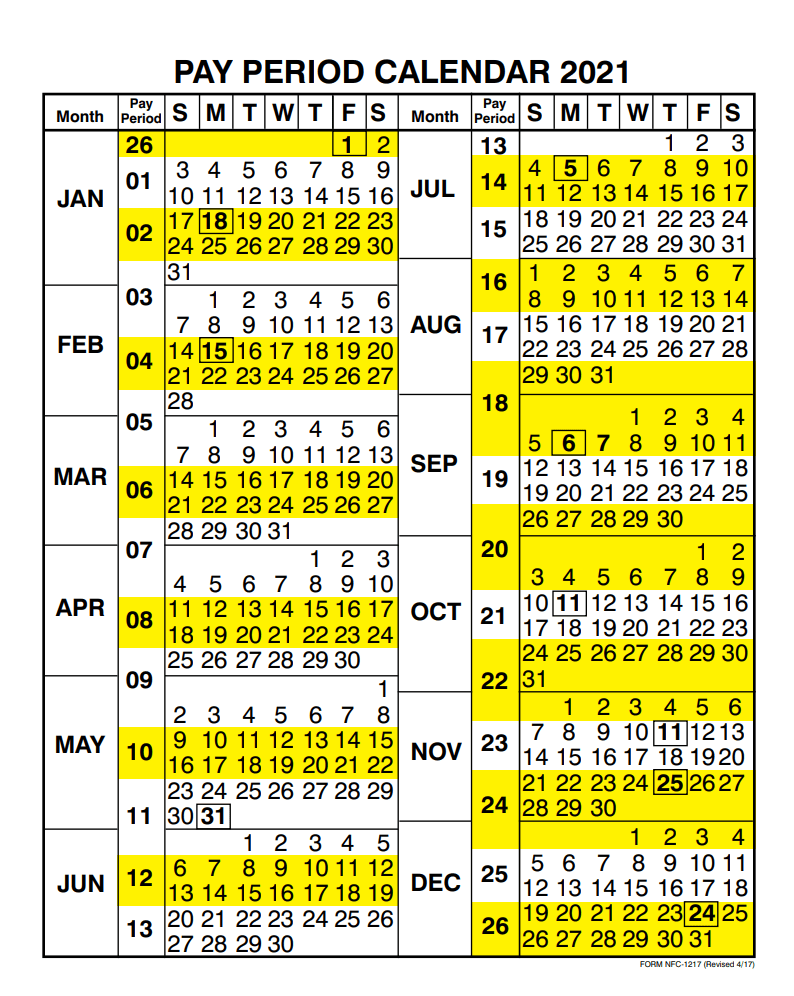

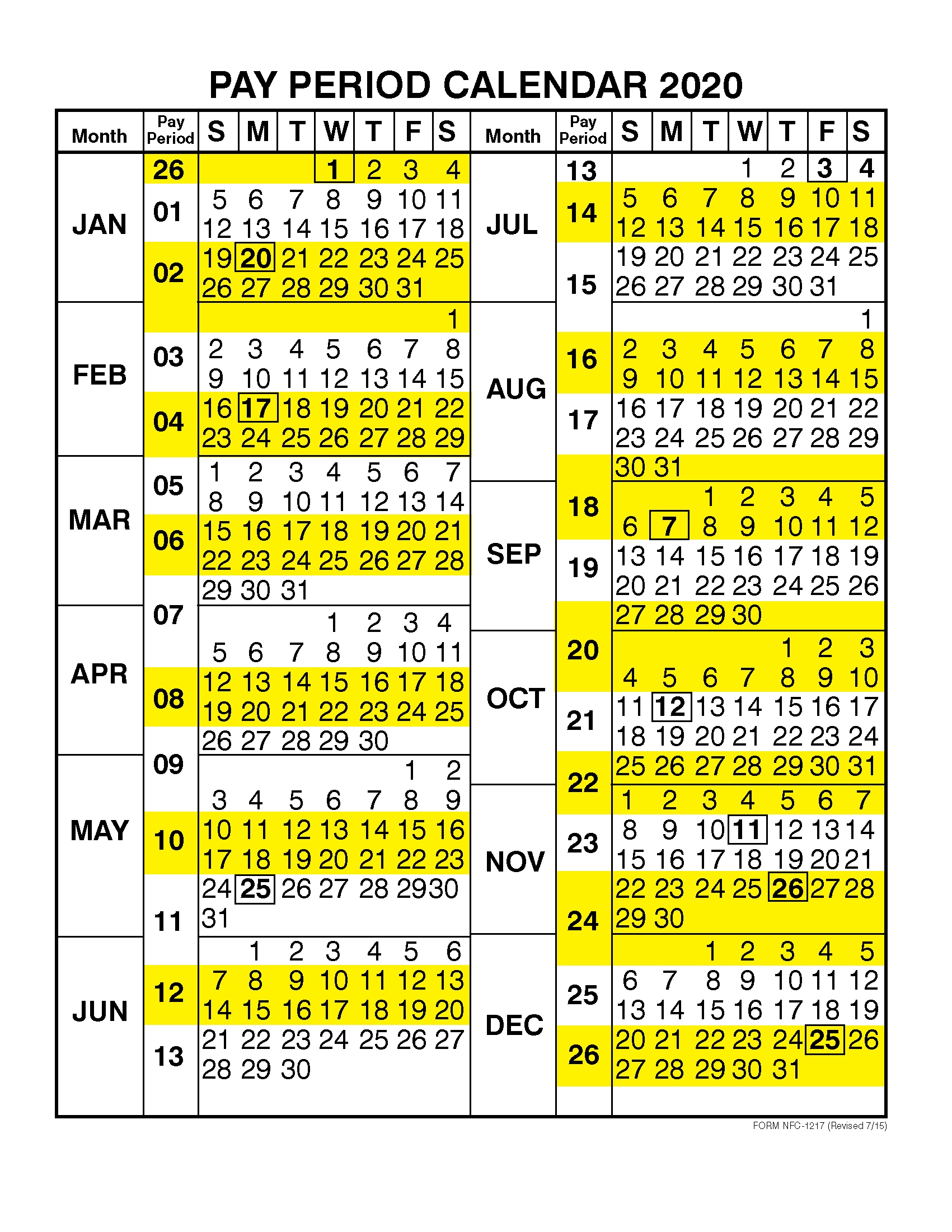

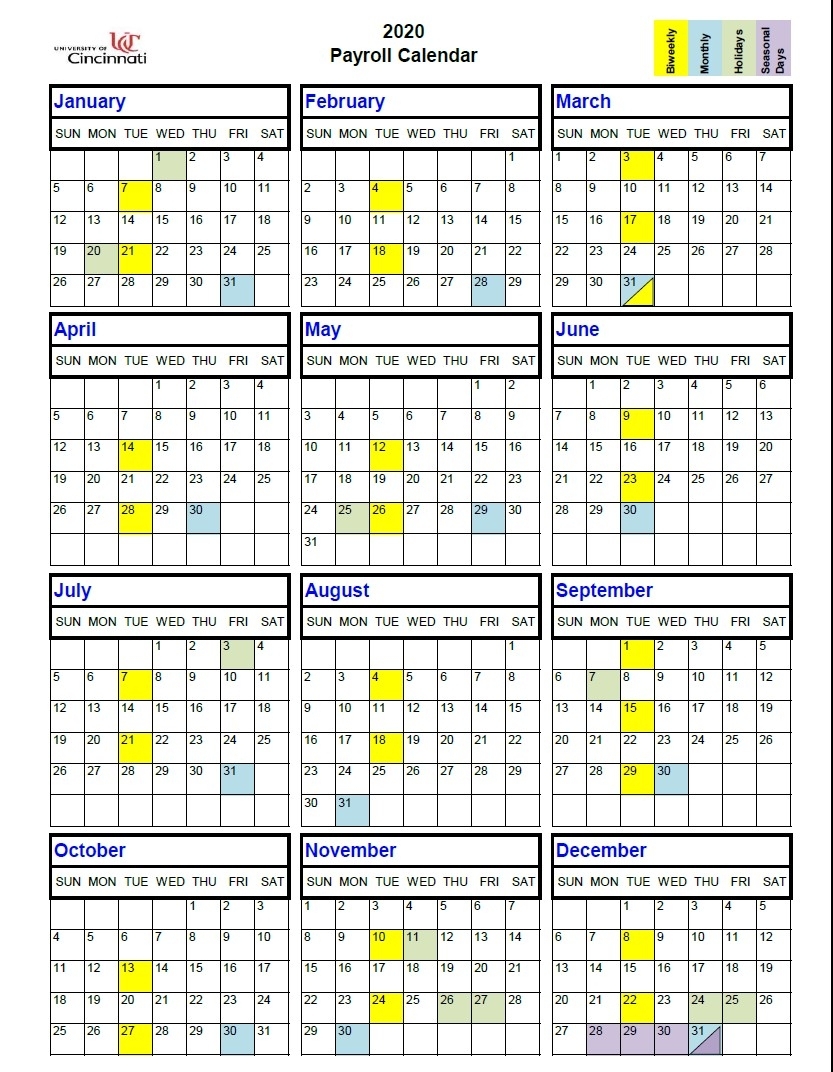

The GS pay period calendar is crucial because it dictates when federal employees receive their paychecks. The calendar typically consists of 26 bi-weekly pay periods, meaning employees are paid every two weeks. Each pay period covers a specific timeframe, and understanding these dates is vital for accurate record-keeping and financial planning. While the exact dates for 2025 are subject to official release by the Office of Personnel Management (OPM), we can provide a framework based on historical trends and projected dates.

Projected GS Pay Period Calendar 2025: A Preliminary Overview

It’s important to reiterate that the following is a projection based on previous years’ calendars. Always refer to the official OPM calendar once released for accurate and definitive dates. The projected calendar will follow a typical bi-weekly pattern, with minor variations due to holidays and weekend adjustments. Expect the first pay period of 2025 to begin in late December 2024 and conclude in early January 2025.

The projected calendar will likely include the following features:

- Bi-weekly Pay Periods: 26 pay periods in total.

- Holiday Adjustments: Pay periods may be shortened or shifted due to federal holidays like New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas. These adjustments can impact payday dates.

- Weekend Adjustments: Pay periods may be adjusted to accommodate weekends, ensuring paychecks are issued on a consistent workday.

- Payday Consistency: While specific dates vary, the payday will typically fall on a consistent day of the week (e.g., Friday).

How to Access the Official GS Pay Period Calendar 2025

The most reliable source for the official GS pay period calendar is the Office of Personnel Management (OPM) website. OPM is the agency responsible for managing federal human resources, including pay and benefits. Their website typically publishes the calendar several months before the start of the year. It’s advisable to bookmark the OPM website and check periodically for updates as the release date approaches.

Key Considerations for Federal Employees Using the 2025 Calendar

- Budgeting and Financial Planning: The pay period calendar is essential for effective budgeting. Knowing the exact pay dates allows for accurate financial planning, ensuring timely payments of bills and other expenses.

- Leave Planning: The calendar helps in planning annual leave, sick leave, and other types of leave. Employees can align their leave requests with pay periods to avoid payroll complications.

- Tax Withholding: Accurate pay period information is vital for proper tax withholding. Understanding the pay frequency helps employees ensure their tax deductions are aligned with their income.

- Retirement Contributions: Federal employees contributing to retirement plans need the pay period calendar to accurately track their contributions and ensure timely payments.

- Direct Deposit: The calendar helps employees verify that their direct deposit information is correctly set up to receive their paychecks on the designated dates.

- Payroll Discrepancies: Having the official calendar allows employees to quickly identify any discrepancies in their paychecks and contact the appropriate payroll office for resolution.

Beyond the Calendar: Understanding Your Pay Stub

The pay period calendar is just one piece of the puzzle. Understanding your pay stub is equally crucial. Your pay stub should clearly show:

- Pay Period Dates: The specific start and end dates of the pay period.

- Gross Pay: Your total earnings before deductions.

- Net Pay: Your take-home pay after deductions for taxes, retirement contributions, and other deductions.

- Deductions: A detailed breakdown of all deductions from your gross pay.

- Year-to-Date Totals: Accumulated earnings and deductions for the year to date.

Regularly reviewing your pay stub helps identify potential errors or discrepancies in your pay.

Preparing for Potential Changes in 2025

While the projected calendar provides a reasonable estimate, remember that unexpected changes can occur. Federal holidays might shift, or unforeseen circumstances may necessitate adjustments. Staying informed through official OPM channels is the best way to remain updated on any modifications to the calendar.

Conclusion

The GS pay period calendar 2025 is a critical tool for federal employees. By understanding its structure and utilizing the official OPM resources, federal employees can effectively manage their finances, plan their leave, and ensure the accuracy of their payroll. Remember to check the OPM website regularly for the official release of the 2025 calendar and always cross-reference your pay stubs against the official calendar to ensure accuracy. Proactive planning and consistent monitoring are key to successfully navigating the complexities of the GS pay system. This comprehensive guide aims to provide a solid foundation for understanding the 2025 calendar and empower federal employees to manage their finances and employment effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the GS Pay Period Calendar 2025: A Comprehensive Guide for Federal Employees. We appreciate your attention to our article. See you in our next article!