Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide

Related Articles: Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide

The year 2025 is fast approaching, and with it, the need for meticulous payroll planning. For businesses operating on a semi-monthly payroll schedule, accurate and timely processing is crucial for maintaining employee satisfaction and adhering to legal requirements. This article provides a comprehensive guide to navigating the 2025 semi-monthly payroll calendar, offering insights into its structure, potential challenges, and best practices for efficient payroll management.

Understanding the Semi-Monthly Payroll Cycle

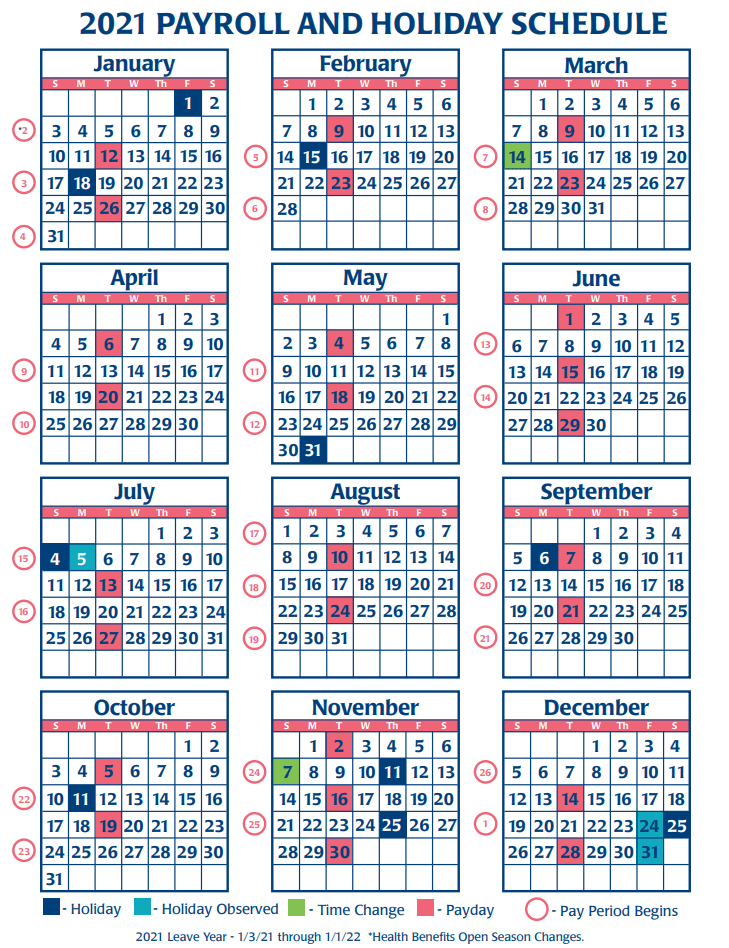

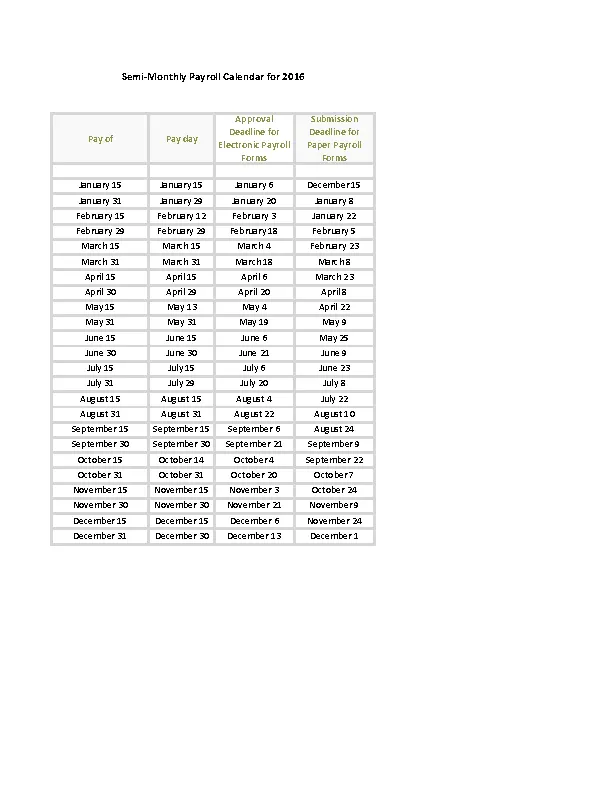

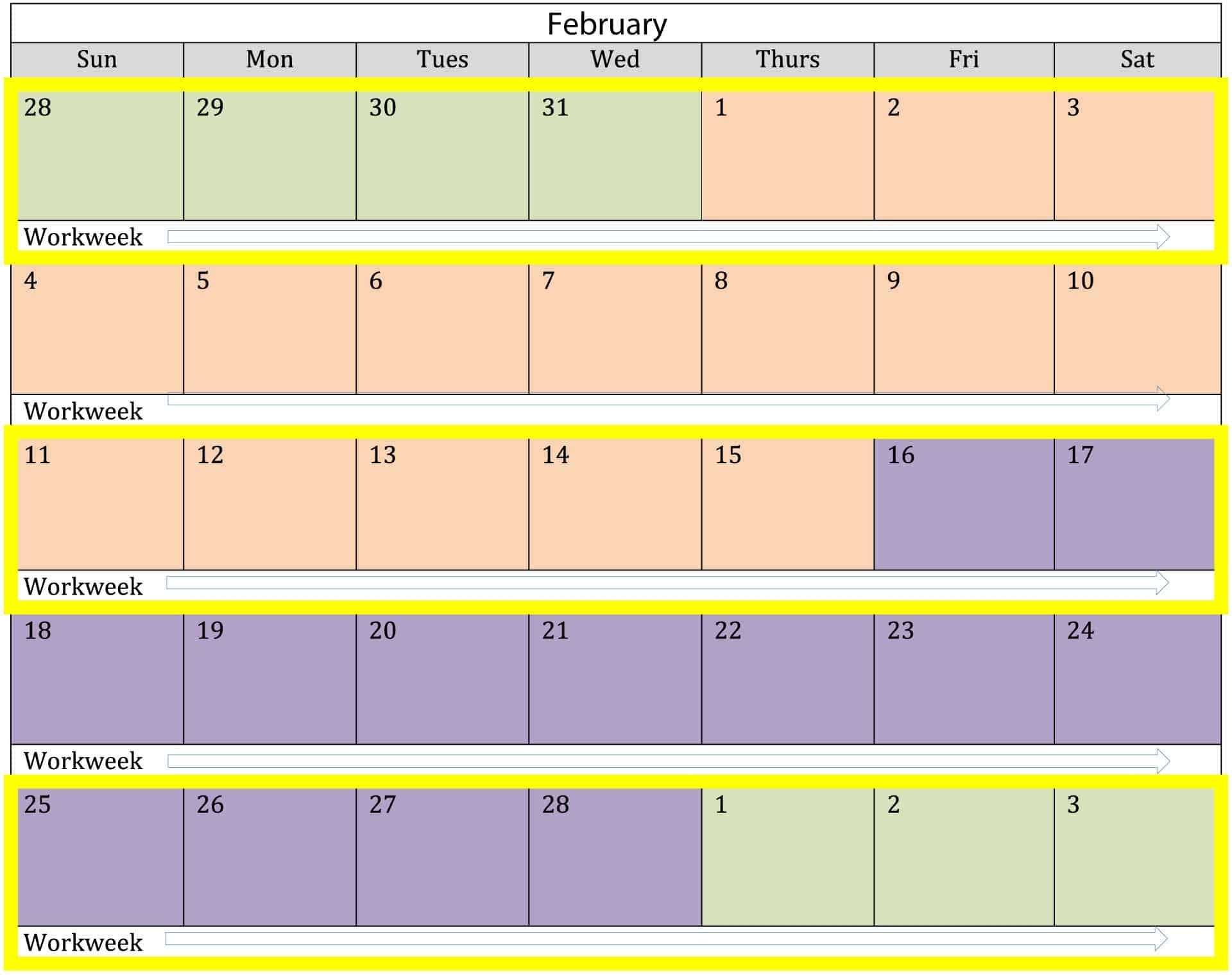

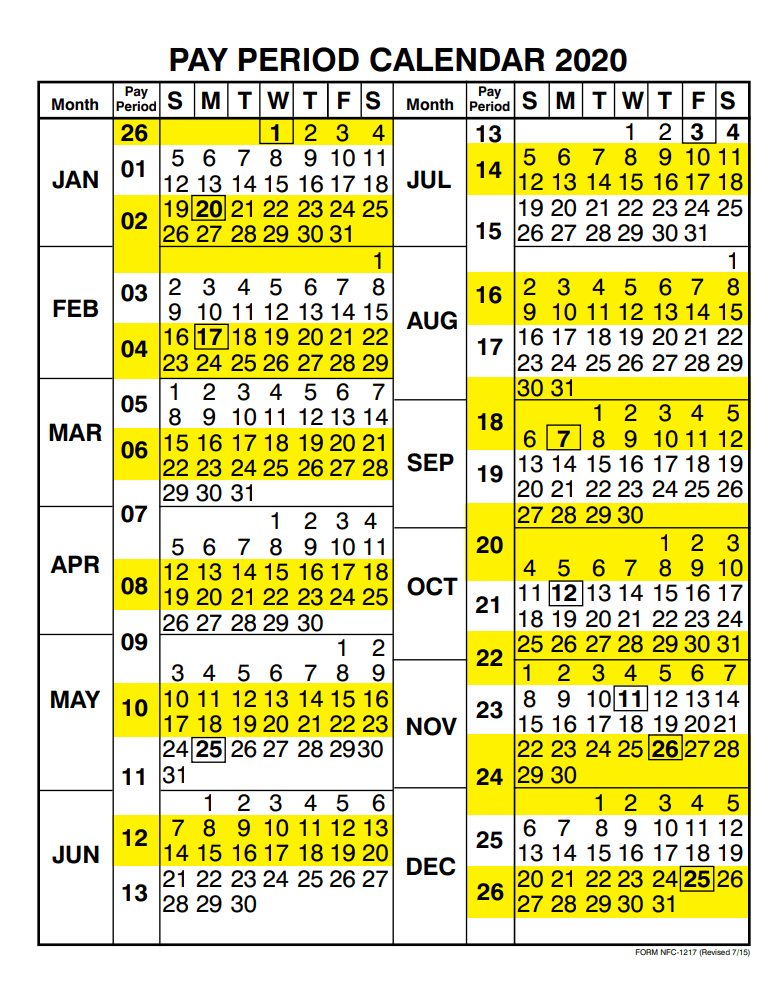

A semi-monthly payroll system means employees are paid twice a month, typically on the 15th and the last day of the month. However, this seemingly straightforward system can present complexities due to varying month lengths and the occasional need for adjustments. Unlike bi-weekly payroll (paid every two weeks), the semi-monthly system always pays on the same days of the month, regardless of the number of days in that month. This consistency can be beneficial for budgeting and financial forecasting, both for the employer and the employee.

The 2025 Semi-Monthly Payroll Calendar: Key Considerations

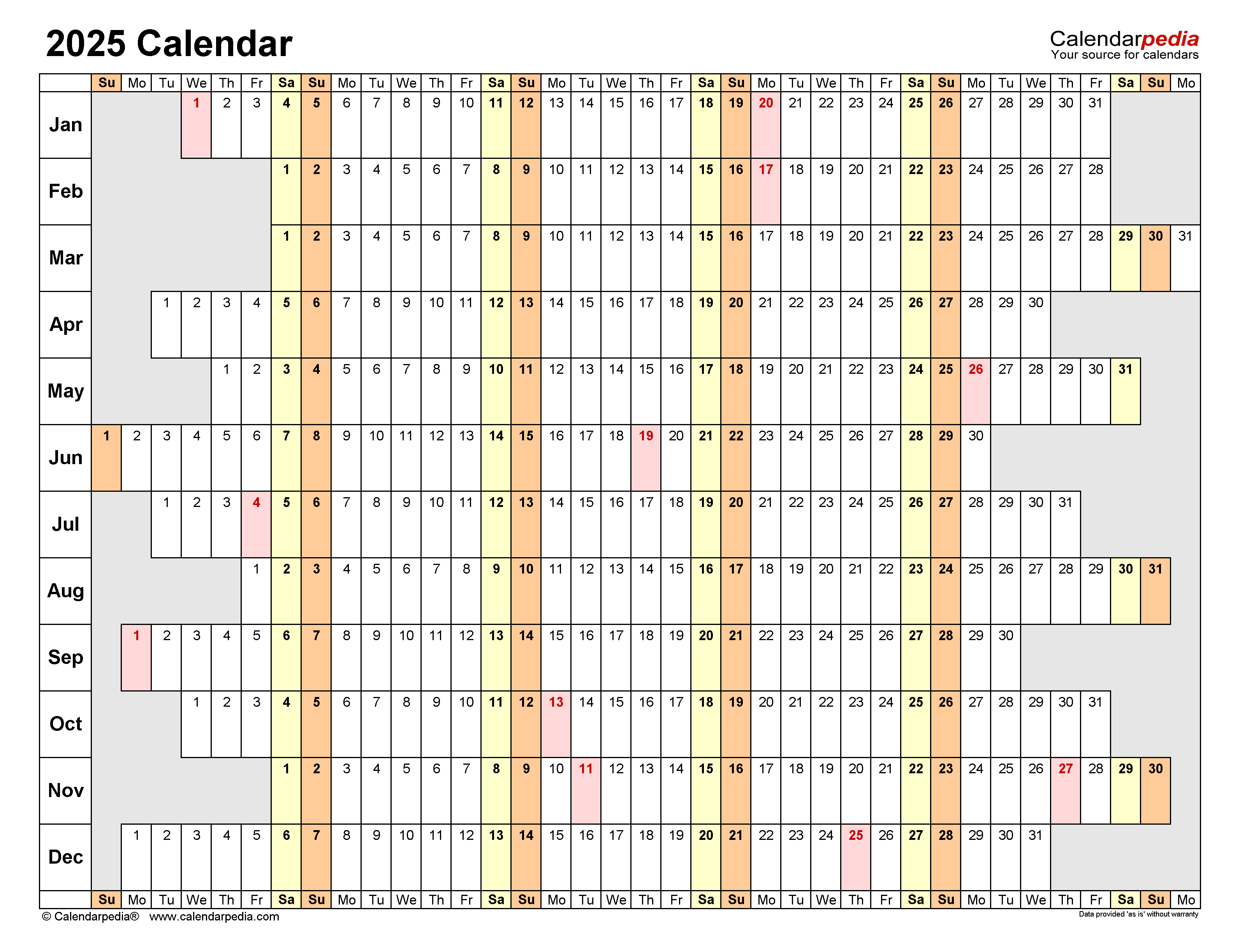

The 2025 calendar presents a standard arrangement of months with varying lengths. This means that the number of pay periods between pay dates will fluctuate slightly. While the 15th and the last day of the month remain constant, the exact number of days covered in each pay period will differ. For example, the pay period encompassing December 15th to December 31st will cover 16 days, while the period from January 1st to January 15th might only encompass 15 days. This variation needs to be considered when calculating employee wages, especially for those paid hourly or based on commission.

Creating Your 2025 Semi-Monthly Payroll Calendar:

To create a precise 2025 semi-monthly payroll calendar, you can utilize several methods:

-

Spreadsheet Software: Programs like Microsoft Excel or Google Sheets are ideal for creating a comprehensive calendar. Simply input the pay dates (15th and last day of each month) and use formulas to calculate the number of days in each pay period. You can also add columns for other crucial payroll data such as gross pay, deductions, and net pay.

-

Payroll Software: Most payroll software packages automatically generate payroll calendars based on your chosen pay schedule. These programs often incorporate features for tax calculations, direct deposit, and reporting, streamlining the entire payroll process.

-

Online Calendar Templates: Numerous websites offer downloadable templates specifically designed for creating payroll calendars. These templates often include pre-formatted cells and formulas, simplifying the process. However, always ensure the template accurately reflects your specific payroll requirements.

Challenges and Solutions in Semi-Monthly Payroll:

While convenient, the semi-monthly system presents some unique challenges:

-

Varying Pay Period Lengths: As mentioned earlier, the inconsistent number of days in each pay period requires careful calculation of wages and other payments. Errors can easily occur if not handled meticulously. Using a spreadsheet or payroll software with built-in calculations minimizes this risk.

-

Year-End Adjustments: The transition from one year to the next requires attention to detail. Ensure accurate accounting for the final pay period of 2024 and the first pay period of 2025. Any discrepancies can lead to inaccuracies in year-end reporting and tax filings.

-

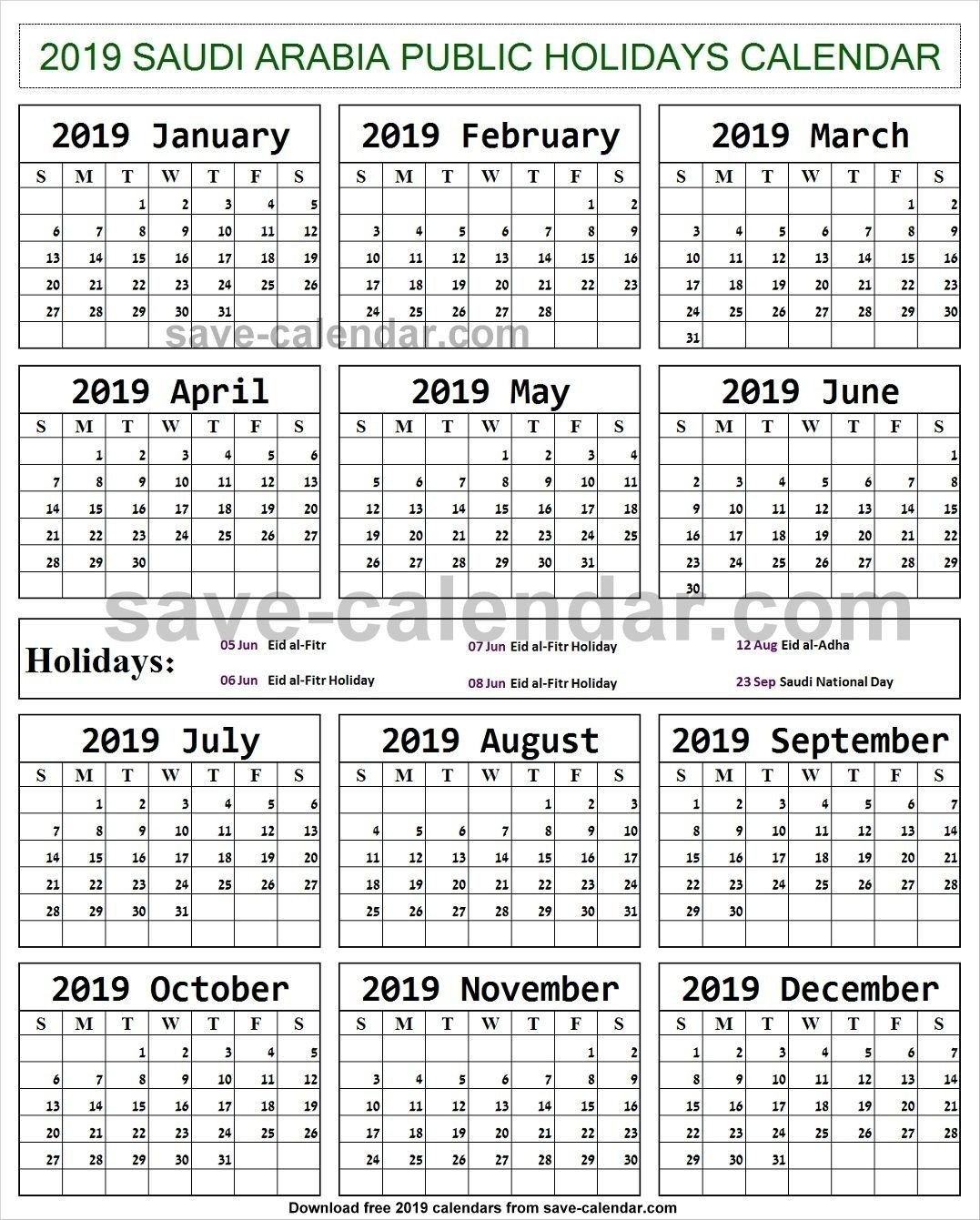

Holiday Pay and Overtime: Holidays falling on or near the 15th or the end of the month require careful consideration of holiday pay policies. Similarly, overtime calculations need to account for the varying lengths of pay periods. Clear guidelines and accurate record-keeping are essential.

-

Compliance with Labor Laws: Adherence to federal, state, and local labor laws is paramount. Ensure your payroll practices comply with regulations concerning minimum wage, overtime pay, and other relevant aspects. Consulting with a payroll specialist or legal professional can help avoid potential legal issues.

Best Practices for Efficient Semi-Monthly Payroll Management:

-

Accurate Time Tracking: Implement a robust time-tracking system to ensure accurate recording of employee hours. This is crucial for calculating wages, especially for hourly employees.

-

Regular Data Backup: Regularly back up your payroll data to prevent data loss. This is particularly important in case of system failures or accidental deletion.

-

Automation: Utilize payroll software and automation tools to streamline the payroll process. This reduces manual effort, minimizes errors, and frees up time for other critical tasks.

-

Employee Self-Service Portals: Consider implementing an employee self-service portal where employees can access their pay stubs, W-2s, and other payroll-related information. This increases transparency and reduces administrative burden.

-

Regular Audits: Conduct regular audits of your payroll process to identify and address any potential issues or inefficiencies. This helps ensure accuracy and compliance.

-

Professional Assistance: If you lack the expertise or resources to manage payroll effectively, consider outsourcing to a professional payroll service. These services handle all aspects of payroll processing, ensuring compliance and accuracy.

Conclusion:

Successfully navigating the 2025 semi-monthly payroll calendar requires careful planning, attention to detail, and the utilization of appropriate tools and resources. By understanding the potential challenges and implementing best practices, businesses can ensure accurate, timely, and compliant payroll processing, fostering positive employee relations and maintaining financial stability. Remember that consistency, accuracy, and proactive planning are key to a smooth and efficient payroll process throughout the year. Don’t hesitate to seek professional assistance when needed, ensuring your payroll operations run smoothly and contribute to your overall business success in 2025 and beyond. Proactive planning and the use of appropriate technology will help you avoid common pitfalls and ensure a successful year of payroll management.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Semi-Monthly Payroll Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!