Navigating the 2025 Ex-Dividend Date Calendar: A Comprehensive Guide for Investors

Related Articles: Navigating the 2025 Ex-Dividend Date Calendar: A Comprehensive Guide for Investors

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Ex-Dividend Date Calendar: A Comprehensive Guide for Investors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Ex-Dividend Date Calendar: A Comprehensive Guide for Investors

The year 2025 promises a new set of opportunities for income-seeking investors, and understanding ex-dividend dates is crucial for maximizing returns. This comprehensive guide delves into the significance of the 2025 ex-dividend date calendar, providing a framework for strategic investment planning and highlighting key considerations for navigating this critical aspect of dividend investing.

Understanding Ex-Dividend Dates: The Basics

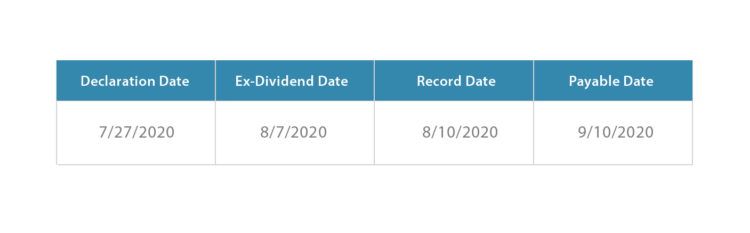

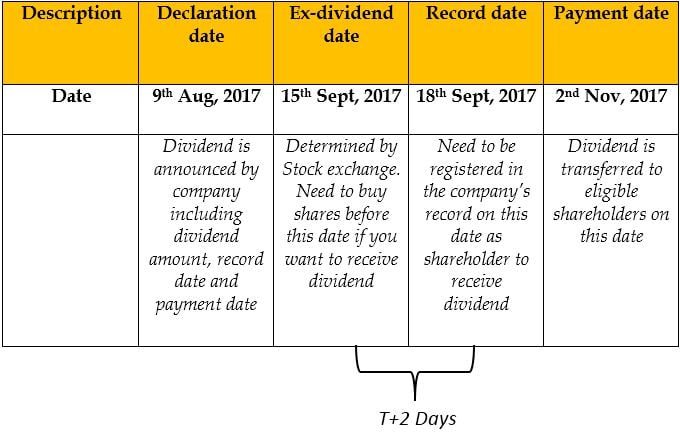

Before diving into the specifics of the 2025 calendar, let’s clarify the concept of an ex-dividend date. The ex-dividend date is the date on which a stock begins trading without the value of its upcoming dividend. If you buy a stock on or after the ex-dividend date, you will not receive the next dividend payment. Conversely, if you buy the stock before the ex-dividend date, you are entitled to the dividend, even if you sell the stock before the payment date.

The ex-dividend date is typically one business day before the record date, the day the company determines which shareholders are eligible for the dividend. This seemingly simple concept has significant implications for investment strategies. Understanding the ex-dividend date allows investors to:

- Strategically time purchases: Investors can buy stocks just before the ex-dividend date to capture the dividend and then sell if desired, potentially profiting from the dividend and any price appreciation.

- Avoid unnecessary costs: Buying a stock on or after the ex-dividend date avoids paying for a dividend you won’t receive.

- Optimize dividend income: Careful planning around ex-dividend dates allows investors to maximize their dividend income throughout the year.

The Challenges of a 2025 Ex-Dividend Date Calendar

While a comprehensive 2025 ex-dividend date calendar would be ideal, creating a precise, publicly available one is practically impossible. This is due to several factors:

- Company-Specific Announcements: Ex-dividend dates are announced by individual companies, and these announcements are spread throughout the year. There’s no central, universally updated repository for this information across all publicly traded companies.

- Unpredictable Events: Corporate actions, such as mergers, acquisitions, or unexpected dividend changes, can alter the schedule.

- Market Volatility: Market conditions can influence a company’s decision regarding dividend payouts, potentially impacting the ex-dividend date.

Where to Find Ex-Dividend Date Information

Despite the challenges, investors have several resources to access ex-dividend date information:

- Company Investor Relations Websites: The most reliable source is the company’s own investor relations website. These sites usually publish press releases and financial calendars detailing upcoming dividend announcements.

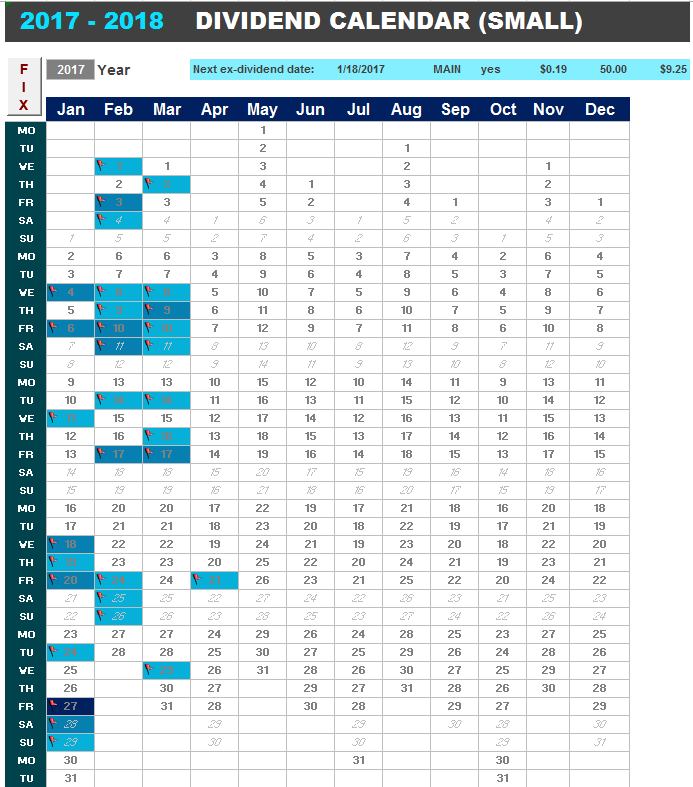

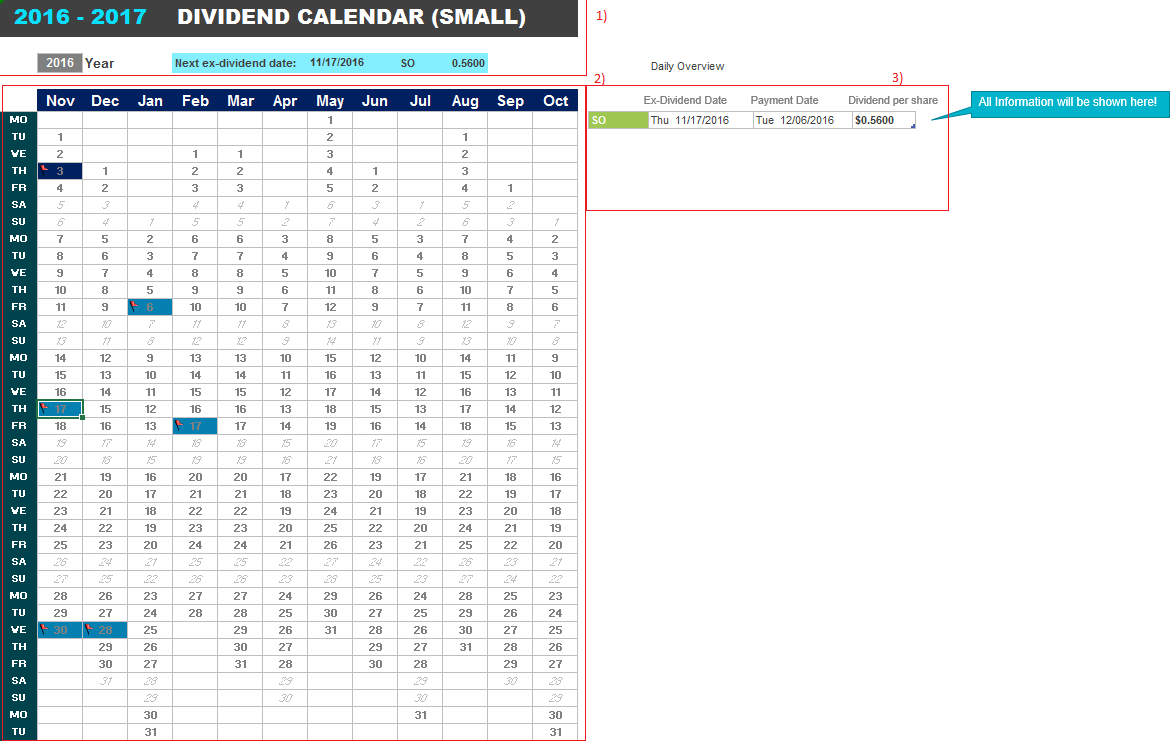

- Financial News Websites and Brokerage Platforms: Major financial news outlets and online brokerage platforms typically provide dividend calendars or tools that allow you to search for specific stocks or track upcoming ex-dividend dates. These resources often aggregate data from various sources, but it’s crucial to verify the information with the company’s official announcements.

- Dedicated Dividend Tracking Services: Several subscription-based services specialize in providing comprehensive dividend tracking and analysis. These services often offer advanced features and detailed historical data.

Strategic Considerations for 2025

While a precise calendar is unavailable, we can discuss strategic considerations for navigating the 2025 ex-dividend date landscape:

- Diversification: Diversifying your portfolio across various sectors and companies reduces the risk associated with relying on any single company’s dividend payouts. A diversified portfolio helps mitigate potential losses from unexpected dividend cuts or suspensions.

- Dividend Growth Focus: Prioritize companies with a history of consistent dividend growth. These companies are more likely to maintain their dividend payouts, providing a more reliable income stream.

- Financial Health Assessment: Before investing in a company based on its dividend, carefully assess its financial health. Examine key financial metrics like debt levels, profitability, and cash flow to ensure the company can sustain its dividend payments.

- Tax Implications: Remember that dividends are taxable income. Factor in tax implications when planning your dividend investment strategy. Consider tax-advantaged accounts like IRAs or 401(k)s to minimize your tax burden.

- Long-Term Perspective: Dividend investing is a long-term strategy. Don’t make impulsive decisions based solely on short-term ex-dividend date opportunities. Focus on building a portfolio of high-quality dividend-paying stocks that align with your long-term financial goals.

- Reinvestment Strategy: Consider reinvesting your dividends to accelerate your portfolio growth through the power of compounding. Many brokerage accounts offer automatic dividend reinvestment plans (DRIPs).

Beyond the Calendar: A Holistic Approach to Dividend Investing

The 2025 ex-dividend date calendar, while elusive in its complete form, underscores the importance of a holistic approach to dividend investing. Focusing solely on the timing of ex-dividend dates without considering the underlying financial health and long-term prospects of the companies is a recipe for potential disappointment.

Successful dividend investing requires a blend of diligent research, strategic planning, and a long-term perspective. By combining a thorough understanding of ex-dividend dates with a comprehensive analysis of company fundamentals, investors can significantly enhance their chances of building a robust and rewarding dividend portfolio in 2025 and beyond. Remember that the information provided here is for educational purposes only and should not be considered financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. The information regarding ex-dividend dates is dynamic and changes constantly, so staying updated through reliable sources is crucial for successful dividend investing.

:max_bytes(150000):strip_icc()/Ex-date_final-78915c0d15d34121ae53b40675961f60.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Ex-Dividend Date Calendar: A Comprehensive Guide for Investors. We hope you find this article informative and beneficial. See you in our next article!